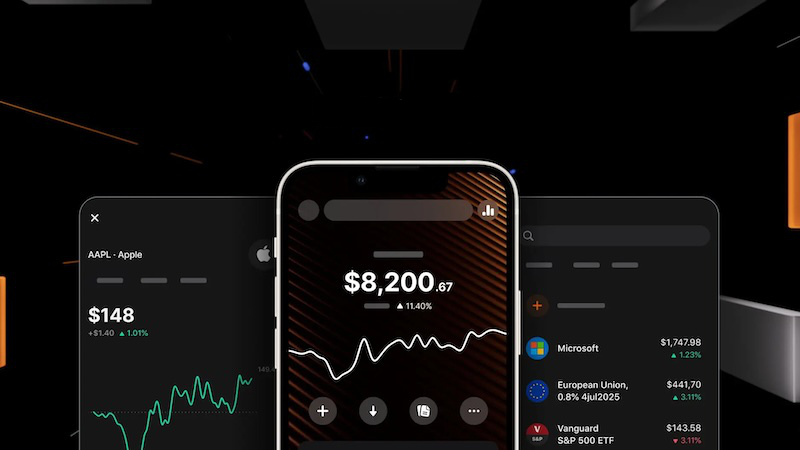

The British neobank Revolut has launched its own trading app: Revolut Invest. It is intended to give private customers access to over 5,000 assets – including stocks, bonds and ETFs.

Revolut, one of the most valuable fintech companies in Europe, is launching its own trading app, “Revolut Invest”. That comes from one report the news agency Bloomberg citing an interview with Rolandas Juteika, head of wealth and trading at Revolut.

Accordingly, the company wants to completely outsource its asset management offering, which is currently worth 8.5 billion euros. The goal: Revolut wants to use its new app to compete with neobrokers such as Robinhood, Bitpanda, Trade Republic and Scalable Capital.

Revolut Invest: When is the trading app coming to Germany?

Revolut Invest is expected to contain around 5,000 assets at its debut. Including: US and European stocks, ETFs and bonds. According to Bloomberg, a flat fee of one euro or 0.25 percent will be charged for investments and stocks and bonds.

This would put Revolut Invest on a par with the German neo-brokers Trade Republic and Scalable Capital. However, the app is currently still in the testing phase. Private investors in Greece, Denmark and the Czech Republic can already use it. If the test phase is successful, Revolut Invest will be introduced in other countries in the European Economic Area at the end of 2024 – reportedly also in Germany.

By then, Revolut plans to double the number of assets available for trading, according to Rolandas Juteika. The company’s goal is to use the trading app to attract private investors in particular. The competition is fierce, but Revolut has already made a name for itself as a neobank. This could help the company gain a foothold as a neobroker.

Premium subscription with higher limits

Revolut already allows retail investors to trade stocks and the like via its banking app. With Revolut Invest, however, the company primarily wants to attract private investors who do not have an account with the neobank and thus acquire new customers.

The new trading app will also include a premium subscription called “Trading Pro”. It aims to reduce commission fees, enable higher limits and provide access to analytics. According to Juteika, anyone who wants to sign up for Revolut Invest must go through the same process as opening a Revolut bank account.

To be specific: Revolut Invest users can theoretically use all the functions of the banking app if they download it. Bank customers should, in turn, continue to have the opportunity to make investments via the banking app.

Also interesting:

- Stock market crash? No need to panic – stock market corrections are normal

- Bear market: 5 reasons that will make you sleep better on the stock market

- The S&P 500 stock index is no longer a good benchmark – that’s why

- These are the biggest daily gains on the stock market

The article New trading app “Revolut Invest” – soon also in Germany? by Fabian Peters first appeared on BASIC thinking. Follow us too Facebook, Twitter and Instagram.

As a Tech Industry expert, I am excited about the introduction of the new trading app “Revolut Invest” in Germany. With its user-friendly interface and low fees, this app has the potential to revolutionize the way people in Germany invest in the stock market.

Revolut Invest offers a wide range of investment options, including stocks, ETFs, and cryptocurrencies, making it a one-stop-shop for all investment needs. The app also provides real-time market data and personalized investment recommendations, making it easier for users to make informed decisions about their investments.

Overall, I believe that Revolut Invest has the potential to disrupt the traditional investment industry in Germany and make investing more accessible and affordable for a wider range of people. I look forward to seeing how this app performs in the German market and how it will continue to innovate and improve the investment experience for users.

Credits